More Americans are turning 65 this year than any prior time in history.

Today’s 65-year-olds are redefining a milestone long associated with retirement parties and the end of productive years. They are wealthier and by many measures, healthier, and expected to live another 20 years. A growing share are divorced. Many turn their focus to what they want in this next stage.

“Being 65 is not just thinking about who you were, but what you might become in a new chapter,” says Ken Dychtwald, CEO of Age Wave, a California-based consulting firm specializing in aging-related issues.

Our own parents and grandparents, he says, weren’t typically thinking of new ventures and possibilities at 65. “They were winding down,” he says.

About 4.1 million Americans will reach 65 years old this year, reaching a surge that will continue through 2027, according to an analysis by Jason Fichtner, executive director of the Retirement Income Institute and chief economist at the Bipartisan Policy Center. That is about 11,200 a day, compared with the 10,000 daily average from the previous decade, he says.

Robin Darrow, vice president of sales and marketing at Scentrifugal Events, turns 65 in a few months but has no plans to retire because she loves her work and also can’t afford to retire. Darrow, who lives in the Philadelphia area, helped found the company in 2016, which offers “create your own fragrance” events at meetings and celebrations.

“I’m not winding down. I’m just starting,” she says.

Working longer

Nearly 20% of Americans 65 and older were employed in 2023, which is nearly double the share of those who were working 35 years ago, according to a recent report from the Pew Research Center.

“More are working and tending to work more hours,” says Richard Fry, a senior researcher at Pew, who conducted the study. Close to two-thirds of 65 and older employees are working full time, compared with nearly half in 1987, he says. They’re earning more, too, with average hourly pay reaching $22 an hour in 2023, up from $13 an hour in inflation adjusted dollars in 1987, according to the Pew report.

Many in this age group are working because they need the money now, or want to build a bigger retirement reserve so they don’t outlive their savings, says AARP’s Carly Roszkowski. They also enjoy their work, and the opportunity for ongoing learning and social connections, she says.

More wealth

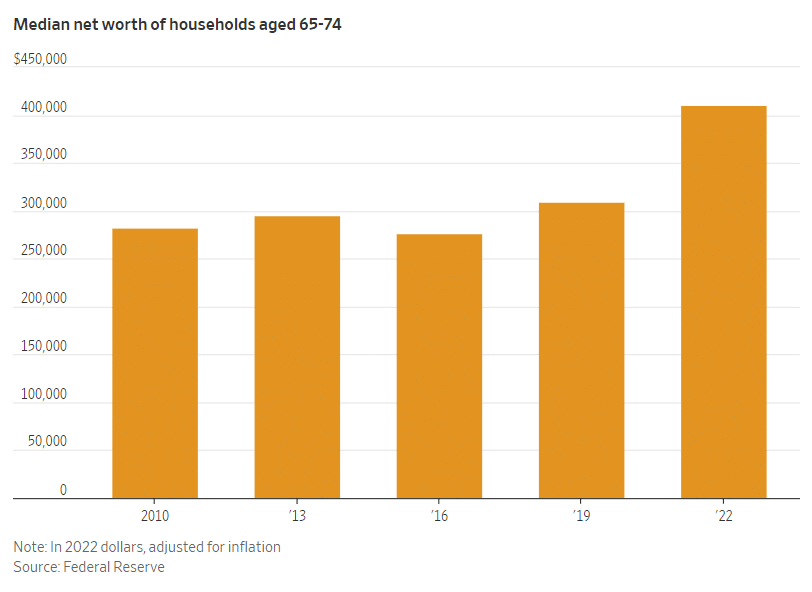

Today’s 65-year-olds are wealthier than their predecessors. While significant disparities exist, the median net worth of those 65 to 74 was $410,000 in 2022, up from $282,270 in 2010 in inflation-adjusted 2022 dollars, according to the Federal Reserve’s Survey of Consumer Finances.

“This is one of the untold success stories of the modern economy: There is a lot more wealth as people enter retirement,” says Ben Harris, director of the Retirement Security Project at Brookings Institution and former chief economist at the U.S. Treasury Department.

Some of that 45% increase in net worth reflects rising values of homes and retirement accounts. Not all baby boomers have fared as well: Those 75 and older had a 13% gain in median net worth over the same period.

Today’s 65-year-olds have more to spend now, but fewer have pensions that offer protected monthly income. They have to depend on savings, investments and Social Security to last, and cover expected rising caregiving costs, says Fichtner, with the Bipartisan Policy Center.

Mark Emerson, 65 of Watertown, N.Y., retired last year after a 40-year-career as a diesel- truck mechanic, first as a small-business owner and then with a large logistics company. He has retirement savings, but would have had more if he spent his entire career with the logistics firm, which had a company retirement savings program.

Still he says has done relatively well. His parents lived comfortably into their 80s on a small pension and Social Security, but “we’re better off financially than they were,” says Emerson, who has a summer cottage on Lake Ontario and a fishing boat.

Active lifestyles

A greater share of 65-year-olds reported meeting federal physical activity guidelines of 150 minutes of moderate-intensity aerobic activity a week and strength training in 2018 than in 1998, according to researchers from the Centers for Disease Control and Prevention.

Staying active and muscle strengthening can help reduce the risks of falls, cardiovascular disease, depression and Alzheimer’s disease.

Gina McRae, an administrative coordinator for a consulting business, turned 65 in early February. Every weekday morning at about 7 a.m., McRae turns on her TV and works out for about 30 to 45 minutes with SeniorShape or other YouTube instructors, alternating between strength, aerobics and yoga in her Beltsville, Md., basement.

Her routine began in 2019 in part to lose weight and also because she wanted to be more active than her mom, whose exercise consisted of yard work. “I’m in better shape than she was at 65,” she says

Living single

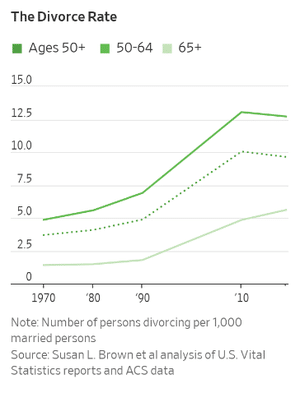

The divorce rate among people 65 and older has more than tripled since 1990, says sociologist Susan Brown, co-director of the National Center for Family and Marriage Research at Bowling Green State University in Ohio.

It isn’t clear why a larger share of 65-year-olds are getting divorced, but it could be partly the result of longevity.

Today’s 65-year-olds can reasonably expect to live another 20 years and might not want to spend it in an unhappy marriage, says Brown. They often end up living alone, although not everyone can afford doing so.

“Americans prize independence and autonomy,” she says.

A higher purpose

Having a purpose matters more than having youthfulness among people 50 and older, according to a Harris Poll survey conducted for Age Wave. It’s good for our health: It can lower the risk of Alzheimer’s disease, heart disease and stroke and can make people happier.

“A lot of people are thinking forward. What am I going to do? Where am I going to live? How can I have a legacy?” says Age Wave’s Dychtwald.

Craig Pampeyan, who turns 65 in May, retired last year from the tech industry where he spent his 40-year career. He’s not done yet. He received an Encore Fellowship, which matches seasoned professionals with social impact organizations. Pampeyan, who had been a Cub Scout and Eagle Scout, was paired with Boy Scouts of America to help with strategy and planning.

“I had to figure out how to get engaged for the next chapter of my life,” says Pampeyan, who lives in Los Altos, Calif. After his fellowship ends in November, he expects to continue working with youth, either on his own or through an organization. “I’m interested in preparing kids for life,” he says.

IMPORTANT DISCLOSURES Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2021.