Home prices are now falling and new rents rising much more slowly./Photo: Micah Green/Bloomberg News

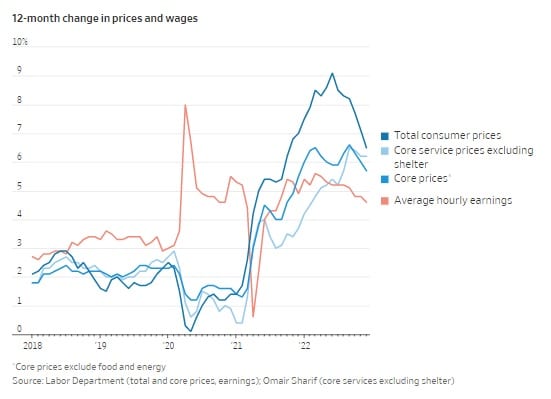

December’s consumer price data add to a picture of inflation, across a broad range of definitions, coming down.

In fact, just as the U.S. got used to thinking high inflation could be here to stay, signs are emerging that most of the surge through 2021 and the first half of 2022 was actually transitory—as Federal Reserve officials first thought.

This doesn’t mean the inflation battle is over. Even the most favorable interpretation still leaves current, underlying inflation above the Fed’s 2% target. Nor does it mean the Fed’s initially sanguine diagnosis was right. After all, it is because the Fed discarded that diagnosis and raised interest rates sharply last year to fight inflation that some prices are starting to drop, especially of houses.

When Fed officials first used the word transitory, it was widely interpreted as “brief.” A more nuanced interpretation was that many prices were rising because of idiosyncratic supply-demand imbalances that would wash away as the economy normalized.

Normalization took far longer than almost anyone expected, but is clearly under way in several key product markets. Most intriguing, it may also be happening in the labor market, the focus of Fed thinking on how high, and for how long, rates must go.

Overall U.S. inflation hit a 41-year high of 9.1% in June in part because energy prices— which began rising as the world reopened from pandemic lockdowns in 2020—jumped with Russia’s invasion of Ukraine last February. But gasoline, which hit an average of $5 a gallon in June, is now down to $3.27, according to AAA. That’s an important reason inflation is now down to 6.5%.

Prices of long-lasting goods, especially automobiles, shot up as locked-down consumers splurged and parts shortages drove up prices. But demand for such goods has softened as the pandemic recedes and the parts shortage improves. Used-car prices have been falling since July, and new car prices dropped in December. That has helped push core inflation, which excludes food and energy, down to 5.7% from 6.6% in September. The pandemic and ultralow interest rates fueled a boom in purchases of larger houses or houses in different parts of the country. Meanwhile, builders struggled with shortages of land, materials and workers. All those factors have receded, and home prices are now falling and new rents rising much more slowly. Shelter costs still rose 0.8% in December from November and 7.5% from a year earlier because of lags in how the Labor Department measures them.

What energy, cars and housing all have in common were a combination of concentrated demand and restricted supply. When some buyers will pay almost anything to get their hands on a finite supply, prices can rise vertically. Textbook examples include European governments paying almost any price to procure enough natural gas, rental companies paying almost any price for used cars to rebuild their fleets, and migrants from U.S. coasts paying almost any price for houses in interior markets. Much of the economy seemed to have adopted the “surge” pricing used by ride-sharing services, Minneapolis president Neel Kashkari has written.

Such dynamics aren’t sustainable. Either demand self-destructs, or supply responds, or both, which happened to varying degrees in all of these markets. In none are prices about to return to where they were before the pandemic. But for inflation to fall, they don’t have to: They only have to stop rising. That’s why their effect on inflation is transitory.

Once transitory influences are gone, what’s left is underlying inflation, which in theory can only stay high if the demand for goods and services persistently exceeds the supply, i.e. the economy overheats, or if the public begins to expect higher inflation and sets prices and wages accordingly. At that point, expectations of higher inflation are self fulfilling.

There are two ways of teasing out underlying inflation. The first, which the Fed prefers, is to exclude food, energy, goods and shelter, a proxy for all the inflation that isn’t transitory. In December, those prices were up 6.2% from a year earlier, according to calculations by independent inflation analyst Omair Sharif, way too high for the Fed’s comfort. (They were only up 2.9% at an annual rate in the past three months, though that figure is quite volatile.)

So at first blush, that’s worrisome. But the second way is to look at wages, which provide more comfort.

Wages in the Fed’s view, are the main determinant of these service prices. The Fed worries about wages now because the labor market is exceptionally tight. The unemployment rate ended 2022 at a 53-year low of 3.5%, well below the Fed’s long-run estimate of 4%. There were 1.7 vacancies for every unemployed worker in November, compared with the prepandemic high of 1.2.

But what if that tight labor market isn’t actually having the expected effect? If it were, we’d expect wage growth to accelerate—or at least, stay strong—as long as unemployment persists below its long-run level. That didn’t happen. December data and revisions to prior months released Friday clearly show hourly wage growth slowed over the course of the year. The 12-month change dropped, from 5.6% in March to 4.6% in December. Wages grew at 4.1% annual rate in the last three months of the year—a bit above the rate compatible with 2% inflation, but not by much.

Perhaps employers in late 2021 and the first half of 2022 were like buyers of cars, houses and natural gas: willing to pay almost any price. Think of a restaurant unable to open until it finds a dishwasher: It will clearly pay more than if it were already fully staffed. Many employers have turned to signing bonuses and one-off pay bumps to attract or retain employees, which may explain why wages accelerated so much, especially for lower-skilled, lower-paid occupations.

That urgency may be receding. In 2019 less than 2% of job postings on job site Indeed mentioned “signing bonus,” according to Nick Bunker, director of North American research at Indeed Hiring Lab. By last August, that had climbed to 5.6%. It has since slipped to 5.1%. The drop is more pronounced for lower-paid occupations: The proportion has fallen to 2.9% at the end of 2022 from 4.4% a year earlier.

Still, even if a lot of wage and price growth does prove transitory, that won’t necessarily comfort the Fed. When officials began using the term “transitory” in March, 2021, the unemployment rate was 6% and consumers expected about 3% inflation in the coming year. In other words, the main determinants of underlying inflation—aggregate supply and demand and expectations—justified a sanguine outlook. Not any more. Unemployment is now 3.5% and consumers expect 4.6% inflation in the coming year, according to the University of Michigan. This is why the Fed can’t signal an end to interest rate increases yet and the risk of a recession can’t be dismissed.

Still, compared with a few months ago, the case for both Fed stringency is a little less compelling and the odds of a soft landing somewhat better. Thank the improbable comeback of “transitory.”

IMPORTANT DISCLOSURES Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2021.