Much of our trading activity is based on Macro forecasts. The main indicators we focus on are Inflation and Growth. Our main thesis of 2024 was that inflation would continue to rise, but at a slower pace than 2021 through 2023 (Disinflation). The foretold recession became less probable while inflation slowed. We remained overweight of US stocks while keeping our bond positions in shorter duration assets. Although this was more of a contrarian view, it helped us take advantage of a strong stock market while not experiencing significant deterioration in the bond holdings. We remain cautious about the Federal Reserve’s interest rate policy and contend that inflation will pick up pace again. We do believe the equity markets will be strong starting the New Year while Fixed Income markets continue to try to find their way with new inflation levels.

For Educational Purposes:

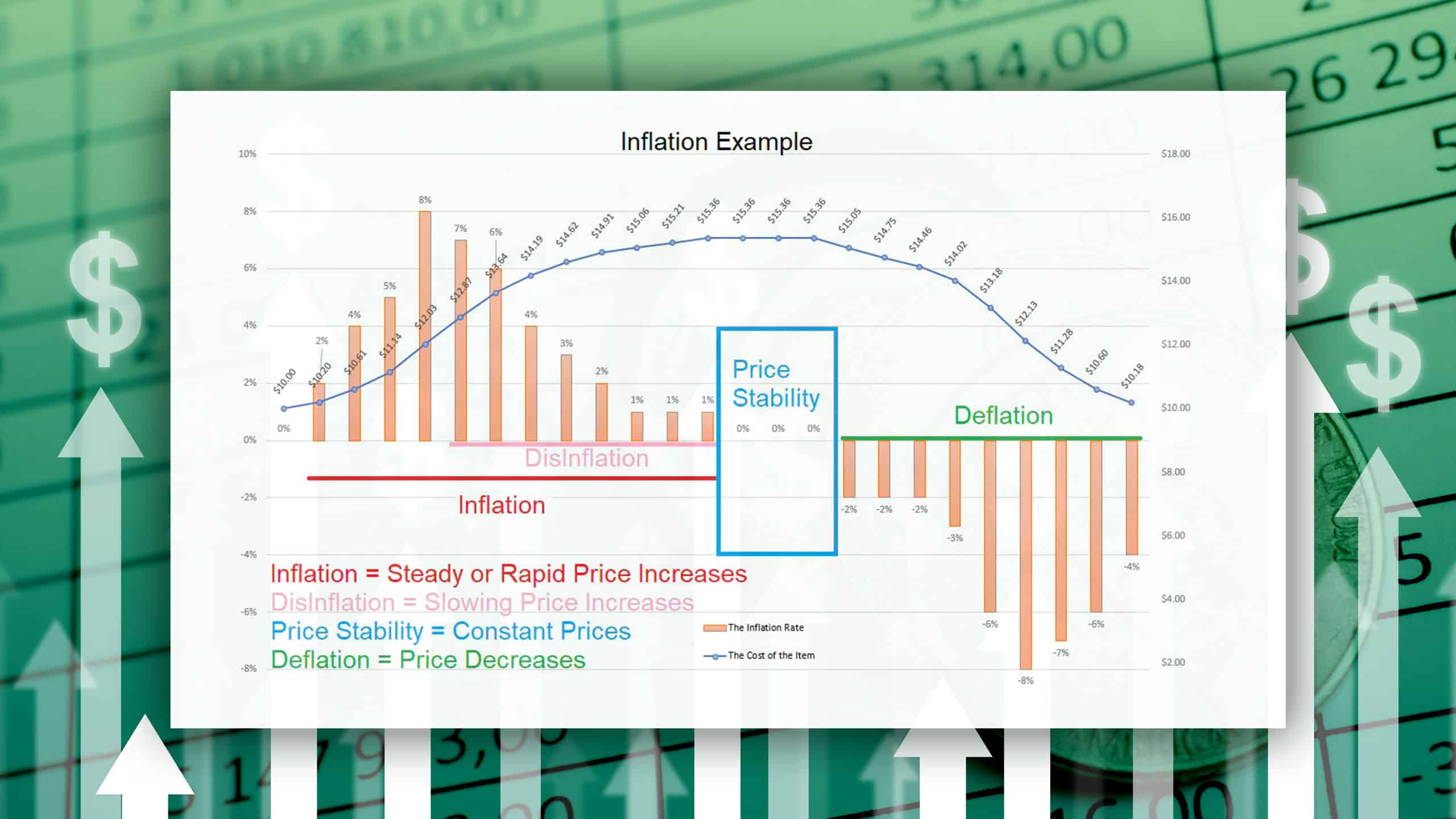

Inflation is generally expressed as an increase in prices, while deflation as a decrease in prices. Inflation is really a decrease in Purchasing Power, while Deflation is an increase in Purchasing Power. A common misconception is that lower inflation means lower prices, when it is in fact, simply that Prices are increasing slower than before, but still increasing (losing Purchasing Power at a slower pace).

The example below illustrates how the price of a good (Blue line) can rise on the left half of the chart through both Inflation and Disinflation. The Price stabilizes in the middle of the chart and then falls through the Deflation period on the right side.