News

Adopt These 9 Habits and You’ll Be Unrecognizable By the End of 2024

Our habits impact how we live, our health and shape and determine our daily and long-term outcomes. Positive habits can supercharge ... read more

10 Years and Counting: Points to Consider as You Approach Retirement

If you're a decade or so away from retirement, you've probably spent at least some time thinking about this major life change. How ... read more

10 Tech Trends That Will Shape the Next Decade

In the ever-evolving landscape of technology, one thing is for sure: Change is constant. As we look ahead to the next 10 years, it is ... read more

5 Money Mistakes That Keep You Poor

Navigating the complicated financial landscape in the United States is challenging, especially considering the varying costs of a ... read more

2 Key Benefits Of Living Trusts

With so many misconceptions around trusts, it's easy to understand the confusion about the benefits of a revocable living trust. A ... read more

Making Sense Of The Child Tax Credit And Similar Sounding Tax Breaks

The House has passed a bill to expand the child tax credit (CTC). The proposal would phase in a refundable portion of the CTC and ... read more

Estate Taxes

What are estate taxes? There are many factors that you should consider when designing an estate plan. One of the most significant is ... read more

Bulletproof Your Tax Return to Avoid Costly Mistakes and IRS Audits

It takes about nine hours for most people to do their taxes—more than enough time to mess something up.Filing errors come in many ... read more

Retirement Planning Key Numbers

Certain retirement plan and IRA limits are indexed for inflation each year, and 2024 saw increases in many figures. Some of the key ... read more

Medicare Prescription Drug Coverage

If you're covered by Medicare, here's some welcome news — Medicare drug coverage can help you handle the rising cost of prescriptions. ... read more

Cardiologists on 20 simple, successful steps to a healthy heart

Our hearts are muscles and need proper fuel and rest. Here is how to keep yours on top form – from eating good food to getting plenty ... read more

Exploring The Relationship Between Joy And Finances: Dopamine

There’s a strong correlation between money and happiness . Unfortunately, it is a reality that has an impact on our overall ... read more

30 Years of Serving Our Clients

As we recognize this milestone, we reflect on three decades of delivering trust, growth, and prosperity to those who have entrusted us with their wealth management. We embarked on a mission to empower individuals, families, and organizations by creating personalized strategies to help achieve your goals. read more

Loneliness can be deadly. Just one visit a month with family and friends can help reduce the risk

Don’t underestimate the power of grabbing coffee with a friend or visiting your grandparents. Spending time with friends and family, ... read more

Can I set up a traditional IRA?

Almost anyone can set up a traditional IRA. The only requirement is that you generally must have taxable compensation (typically, ... read more

8 Hours a Night Is a Myth. How Much Sleep You Really Need.

Sleep knits up the raveled sleeve of care, according to Shakespeare, but how much pillow time do we actually need?The short answer is ... read more

Some People Are Just Lucky. You Can Make Yourself One of Them.

Nir Zicherman was a mediocre law student having trouble landing a summer internship. On his way to an interview, he got in an elevator ... read more

How Dogs Help Us Lead Longer, Healthier Lives

Dogs seem to make us healthier than we would be without them. Social psychologist Bruce Headey conducted a survey of Australian ... read more

Tax Incentives for Motor Vehicles

Three federal tax credits may be available to help offset your cost to purchase certain clean vehicles (including electric, plug-in ... read more

2023 Year-End Tax Tips

Here are some things to consider as you weigh potential tax moves between now and the end of the year.1Defer income to next ... read more

Why a Healthcare Bucket for Your Retirement Portfolio Makes Sense

Healthcare costs consume a growing share of retiree budgets over time. Because they typically rise at a rate higher than inflation, do ... read more

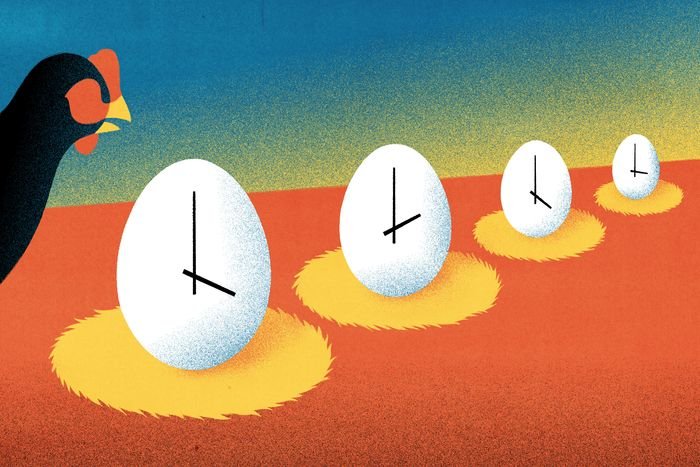

To Retire Someday, When’s The Right Time To Start Investing?

With constantly changing regulations, a market that seems to be continuously in flux, and inflation driving costs up across the board, it can be hard to know when and if you should start investing your money. So how do you know when you should start? read more

Timeless Advice From Ben Franklin That Can Help Investors Succeed

People are creatures of habit. This timeless quote from Benjamin Franklin is very powerful in all areas of life, especially in the stock market. read more

The Power Of Being Proactive: 5 Ways To Develop This Surprising Skill

If you’re trying to get ahead or nurture greater happiness and satisfaction in life and work, there’s a trait you may not have realized is quite so important: the ability to be proactive. read more

Taking The Stress Out Of Financial Planning

“Remember, today is the tomorrow you worried about yesterday.” Those words of early personal development sage, Dale Carnegie, spun around in my brain, and then it hit me: This is the reason financial planning stresses people out. read more

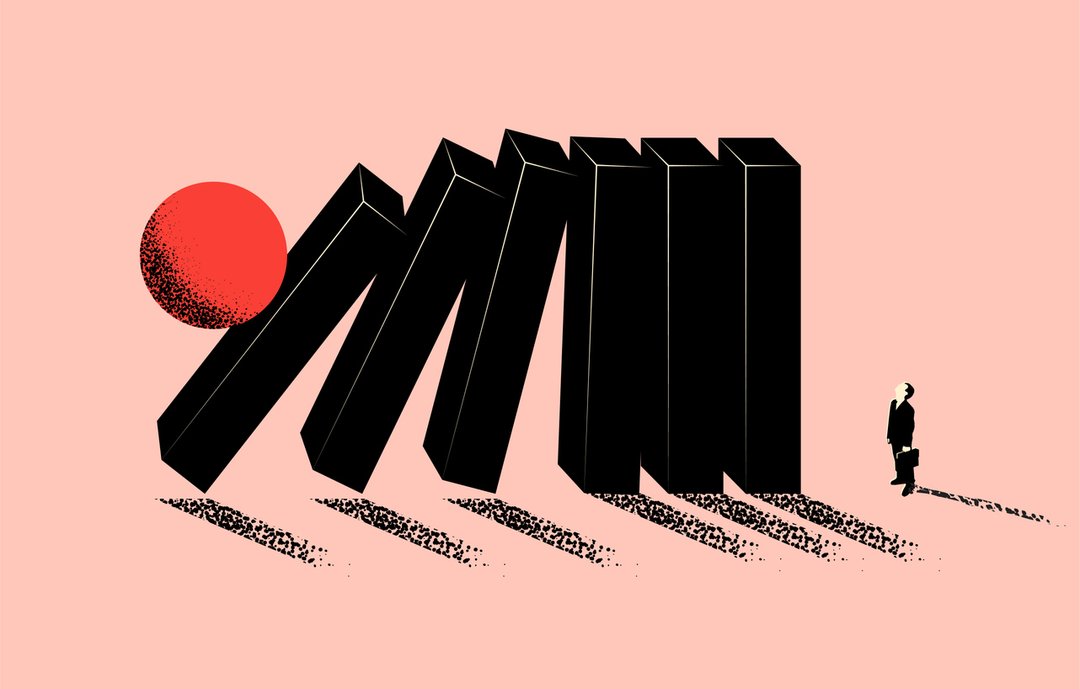

Social Security Benefits Could Shrink in 10 Years. How to Plan.

If the Social Security trust fund runs dry in 2033—which it is projected to do if no action is taken—a couple with average earnings would lose $17,400 in benefits that year alone, according to a new report. read more

Should You Consolidate Your Student Loans? What to Know Before Payments Resume

About 27 million student loan borrowers are bracing for monthly payments on federal loans to resume now that a pause introduced during the pandemic is set to end. read more

Is Good News Finally Good News Again?

Good news is bad news: It had been the mantra in economic circles ever since inflation took off in early 2021. A strong job market and rapid consumer spending risked fueling further price increases and evoking a more aggressive response from the Federal Reserve. So every positive report was widely interpreted as a negative development. read more

TD Ameritrade & Charles Schwab: What you need to know

FAQsWhy do my Statements show different values? Your investment account(s) may have two published statements for the month of ... read more

2024 Key Numbers for Health Savings Accounts

The IRS recently released the 2024 contribution limits for health savings accounts (HSAs), as well as the 2024 minimum deductible and maximum out-of-pocket amounts for high-deductible health plans (HDHPs). read more

3 Ways To Tell If You Are Ready For Retirement

Retirement is more of a balancing act than a one-and-done decision. You have to know if you’re ready before you actually do it. read more

How much cash should you have in your rainy day fund?

It is a first principle of financial planning that everyone needs an emergency fund. The idea is that investors should always have enough money to cover three to six months of regular outgoings in an easy to access account. Just in case the car dies, or a family member loses a job or gets sick. read more

Three Things To Do Before You Retire, And Three Things That Can Wait

As a retirement writer who is working past his normal retirement age, I’ve witnessed a lot of people transition from work to retirement. And I’ve noticed that a source of stress for many is determining which things have to happen at retirement versus which decisions can wait. While every retirement is unique, these are my observations about what issues should be prioritized and what can be delayed. read more

Schwab Alliance Online Access– Easy Secure Access to your account information

Signing up for Schwab Alliance gives you access to your account information virtually anytime, anywhere, while saving time and paperwork. read more

The Biggest Financial Hurdles Young People Face

You've probably relied on your parents to manage your financial matters for years... Then you graduate from college, and suddenly you're responsible for all kinds of important financial decisions. Learning to manage your money is about overcoming four big hurdles. But just because these tasks may be challenging doesn’t mean you can’t take them on. read more

Why It’s Now Easier to Underestimate Your Expenses and Overspend

Many people have a gap between what they think they spend and what they actually spend. This gap has widened recently as the financial and psychological effects of higher prices further strain people’s budgets. read more

Where’s the Recession We Were Promised?

The 2023 recession is missing in action. At the end of last year, economists were more convinced than they’ve ever been that recession was on the way, but it refused to arrive. Now investors, economists and Federal Reserve policy makers are giving up on the idea, expecting the economy to be (a bit) stronger and stock prices and bond yields to be higher. read more

The Retirement Tax Break That Can Pay You an Annual Income

At college reunions and your favorite charity, there is a new ask: Donate up to $50,000 from your individual retirement account and get back monthly retirement paychecks at fixed rates of up to 9.7%, depending on your age. read more

Retirement-Savings Changes You Should Know About for 2023-24

The Secure 2.0 Act, passed in December, contains more than 90 provisions affecting retirement-savings plans, such as individual retirement accounts and 401(k) workplace plans. read more

A 10 Step Financial Workout To Improve Your Financial Health

No matter how out of shape you feel financially, there are steps you can take to bring yourself back to financial health. read more

4 Steps To Plan For Repaying Your Student Loans Once The Pause Ends

Thirty-seven million student loan borrowers will be required to resume their monthly payments in October, more than three years after the federal government paused them due to Covid-19. read more

More Ways to Clean Your Finances

With tax season in the rear view mirror, it’s a great time to give your finances a once-over. You’ve already gone through all your paperwork, you have a pretty clear picture of your money situation, and you’ve got a little time now that you’re no longer digging around for that lost W2. read more

9 Money Moves To Make Mid-Year

Summer is here so it’s time for a mid-year financial checkup. read more

Plan For Your Retirement With This Ultimate Checklist

A regret-free retirement requires several years of planning, putting money aside, and staying the course. read more

Celebrate This Fourth Of July By Taking 5 Steps To Financial Freedom

The Fourth of July is an occasion to celebrate America's independence and the freedoms that we enjoy as citizens of this country. But in “the land of the free and the home of the brave,” many Americans are struggling from a lack of financial freedom, and suffering from the fear and anxiety of not having enough financial security. read more

9 Unexpectedly Powerful Insights From Doing Our Taxes

At the dreaded tax time, when we brace for the bad news of how many of our hard-earned dollars are going to the government. But going through the process of collecting all this financial information about the past year can be so much more than just tax prep. read more

Avoid an Audit by Knowing These 6 Red Flags

If history is any indicator, fewer than 1% of Americans will be audited by the Internal Revenue Service (IRS) in the coming year.1 Of that small amount, some of the audits are totally random. But many are triggered by actions taxpayers themselves have taken. read more

Celebrate yourself 30 ways to make fitness more fun

Even if you like exercise, it can be a drudge. But there are plenty of ways to mix up your regime to make it more joyful. Here is what works for readers, athletes and fitness experts. read more

Laid Off? Job Change? Here’s Why You Should Consider Converting Your 401k To A Roth IRA

The Roth IRA is a popular way for people to save for retirement. Millennials and GenZ can even begin early. read more

Understanding Financial Wellness

Wellness is a concept that has found its way into more and more corners of American life. At its heart, wellness is about adopting practices—like exercising more and eating healthy—that help you live a better life. These practices can also help you improve your financial life, under the rubric of “financial wellness.” This concept is about changing financial behaviors and adopting more effective money habits to secure financial stability and financial freedom. read more

The Tax Play That Saves Some Couples Big Bucks

Spencer Phillips, a 39-year-old orchestral musician who plays the bass violin, loves and trusts his wife of 10 years—but he refuses to file a joint income-tax return with her. read more

The Biggest Mistakes People Make With Their Wills

Everybody knows they should have a will, and not having one can leave heirs with a big mess. But just having a will isn’t enough. Big mistakes are common—from leaving decisions to the last minute and failing to update documents to mismatching beneficiary designations. read more

Successful People Establish Deliberate Morning Routines. Here’s How to Make One for Yourself.

It's no secret that making better choices improves our overall physical, mental and emotional well-being . Creating good habits contributes to increased success in our daily lives and it makes us feel good, and that all starts in the morning. Here's how to build a successful, efficient morning routine that will help you take control of your day — and your life. read more

How to Use Behavioral Nudges to Increase Retirement Savings

The bipartisan legislation recently signed by President Biden requires that all new retirement savings plans incorporate a savings autopilot starting in 2025. This means that workers are automatically enrolled in their retirement plans unless they opt out, and their savings rates are gradually escalated over time. read more

Office Update: Nick Scibilia and Laurie Syta

Effective May 2nd Nicholas (Nick) Scibilia will be taking a leadership role on the Firm’s Investment committee. Nick has been a member ... read more

How to Spring Clean Your Finances

Taking the time to spring clean your finances will give you peace of mind for the rest of the year. read more

How to Help Older People Protect Their Assets

After a lifetime of work, many older Americans have built up a substantial sum in assets. At the same time, they're unlikely to accumulate much additional wealth. For that reason, protecting the assets they already have becomes especially important. read more

Figuring Out Your Life Expectancy is Tough. How Not to Run Out of Money.

If you're using life expectancy calculations to plan your retirement budget, you could run out of money. read more

20 Seconds That Can Break Bad Money Habits

To break the day-trading habit that cost him money, friendships and sleep, fund manager Thomas Meenik first tried meditation and cycling. They proved no substitute for the high he got scrolling through investing forums, he said. Instead, he took a digital breath. He installed software that imposed a 20-second delay whenever he tried to open his apps. Twenty seconds might not seem like much, but feels excruciating in smartphone time, he said. As a result, he checks his accounts 60% less. read more

6 Secrets to Sales Success Hidden in Girl Scout Cookies

Girl Scout Cookies are more than a sugary annual purchase, they are also a lesson in entrepreneurship . Let's bite into the six lessons of success hidden within the cookies. read more

Inflation is Turning the Corner

December’s consumer price data add to a picture of inflation, across a broad range of definitions, coming down. read more

Choose Courage Over Confidence

Self-doubt is a pervasive and often paralyzing concern, and research has repeatedly shown that it can impact women more than men. So what makes high-achievers power through their self-doubt? According to the author’s research, they focus on building up their courage, not their confidence. She offers three strategies to help take bold actions in the face of self-doubt and fear. read more

Battling Inflation: What You Can Do To Protect Your Retirement Plan

Inflation has been hitting everyone hard and going into 2023, there are several things you can be doing in order to protect the state of your finances. read more

Understanding the SECURE 2.0 Act

The SECURE 2.0 Act of 2022 is a law designed to substantially improve retirement savings options—including with 401(k)s and 403(b)s—in the U.S. It builds on the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019. SECURE 2.0 was signed into law by President Joseph R. Biden on December 29, 2022, as part of the Consolidated Appropriations Act (CAA) of 2023.1 The SECURE 2.0 Act began as two pieces of legislation, one from the House of Representatives (H.R. 2954) and one from the U.S. Senate (S. 1770).23 After both branches of Congress passed their respective bills, the consolidated legislation was included in the omnibus budget bill (the Consolidated Appropriations Act of 2023) as Division T (SECURE 2.0 Act of 2022). read more

Top 8 Ways Life Insurance Can Build Generational Wealth

When strategically used, life insurance offers many advantages, including the beneficiaries' ability to build generational wealth. read more

The IRS Says ‘Tax Day’ Will Be Different This Year

It's not too early to start thinking about your 2022 income-tax return, if you can bear the thought. read more

What is the Child Tax Credit?

The child tax credit is a per-child tax credit against your personal income tax liability. The child tax credit is $2,000 per child. read more

10 Tips to Make 2023 Your Best and Boldest Year Yet

Want to be bolder in 2023? Start by clarifying your purpose. Before you take any action, spend some time reflecting on your values and what is most important to you. Visualize where you want to be in 12 months and the kind of life you want to live. Once these goals are clearer, work to create an action plan and write it down. read more

The Joys and Financial Challenges of Parenthood

Parenthood can be both wonderfully rewarding and frighteningly challenging. Children give gifts only a parent can understand—from sticky-finger hugs to heartfelt pleas to tag along on Saturday morning errands. You raise them with a clear goal that you secretly dread will actually take place—that someday they will be grown, independent, and ready to move out on their own, and your work will be over. read more

Should I save for college in my name or my child’s name?

There are three potential drawbacks to saving in your child's name: the kiddie tax, federal financial aid rules, and control issues. read more

10 Years and Counting: Points to Consider as You Approach Retirement

If you're a decade or so away from retirement, you've probably spent at least some time thinking about this major life change. read more

Ten Trends to Watch in the Coming Year

In the coming months the world will have to grapple with unpredictability around the conflict's impact on geopolitics and security; the struggle to control inflation; chaos in energy markets; and China's uncertain post-pandemic path. read more

As You Identify Resolutions For 2023, Here’s How To Navigate Change

One of my most self-aware friends said of a habit he'd like to change recently: "First, I have to get sick of myself; then I have to get sick of getting sick of myself; then I have to complain about it for a while; then I'll actually change." read more

How to Actually Come Back from the Holidays Feeling Refreshed

We are told the winter holidays are supposed to be a magical time of deep connection with loved ones, good meals, warm fires and gift-giving. And yet, for many of us, the winter holidays don't live up to our expectations, because we don't know how to strike the right balance between rest and productivity. read more

Get Big Tax Breaks for 2022 by Acting Now

It's time to make year-end tax moves. With inflation way up and markets way down for 2022, there's plenty to track. read more

What the IRS’s New Tax Brackets Mean for You

Many Americans will see their tax burden drop next year because of inflation adjustments made by the Internal Revenue Service. Some will benefit more than others. read more

Social Security Retirement Benefits

Social Security was originally intended to provide older Americans with continuing income after retirement. Today, though the scope of Social Security has been widened to include survivor, disability, and other benefits, retirement benefits are still the cornerstone of the program. read more

Retirement Legislation Awaits Further Action

Legislation that could benefit people with individual retirement accounts (IRAs) and workplace retirement plans is currently moving through Congress. read more

How to Fall Back Without Missing a Beat

The transition to fall is scattered with seasonal markers: The occasional chill in the air; the wearing of the flannel shirt to the pumpkin patch; the urge to make soup. read more

I think it’s time to start planning for retirement. Where do I begin?

Although most of us recognize the importance of sound retirement planning, few of us embrace the nitty-gritty work involved. With thousands of investment possibilities, complex rules governing retirement plans, and so on, most people don't even know where to begin. Here are some suggestions to help you get started. read more

Should I Buy or Lease a Car?

There is no definitive answer—you must determine which option works best for you. Use these simple guidelines to help you decide. read more

How Can I Reduce My Spending

To reduce your spending, you first need to know where your money goes. Start out by keeping track of all of your expenses for a month. None are too small or insignificant. read more

How can I protect myself against identity theft?

The chance that someone will assume your identity to open fraudulent bank or credit accounts is increasing as thieves become more sophisticated. The best way to protect yourself is to try to prevent this from happening in the first place. read more

Protecting Your Loved Ones with Life Insurance

Your life insurance needs will depend on a number of factors, including the size of your family, the nature of your financial obligations, your career stage, and your goals. As you take on more responsibilities and your family grows, your need for life insurance increases. read more

Social Security: What Should You Do at Age 62?

Although collecting early retirement benefits makes sense for some people, there's a major drawback to consider: If you start collecting benefits early, your monthly retirement benefit will be permanently reduced. So before you put down the tools of your trade, there are some factors you'll need to weigh before deciding whether to start collecting benefits early. read more

WNYAM Volunteered at Sleep in Heavenly Peace

We had the opportunity to volunteer last week at Sleep in Heavenly Peace. Sleep in Heavenly Peace (SHP) is an American nonprofit ... read more

Key Estate Planning Documents You Need

There are five estate planning documents you may need, regardless of your age, health, or wealth: Durable power of attorney, Advance medical directives, Will, Letter of instruction, Living trust. The last document, a living trust, isn't always necessary, but it's included here because it's a vital component of many estate plans. read more

Market Volatility Update

We all know that volatility is a normal part of investing, but when it occurs our patience is tested and managing our emotions can be ... read more

Should I buy long-term care insurance?

As we get older and our health declines, the greater the chances are that we will require home care, nursing home care, or other assisted-living arrangements. This care is quite expensive, and Medicare, HMOs, and Medigap don't pay for it. You might want to look into purchasing long-term care insurance (LTCI) to protect your assets in case you need long-term care. read more

Converting Savings to Retirement Income

During your working years, you've probably set aside funds in retirement accounts such as IRAs, 401(k)s, or other workplace savings plans, as well as in taxable accounts. Your challenge during retirement is to convert those savings into an ongoing income stream that will provide adequate income throughout your retirement years. read more

Maintaining your financial records: The Importance of being Organized

An important part of managing your personal finances is keeping your financial records organized. Whether it's a utility bill to show proof of residency or a Social Security card for wage reporting purposes, there may be times when you need to locate a financial record or document—and you'll need to locate it relatively quickly. read more

Should You Pay Off Your Mortgage or Invest?

Is it smarter to pay off your mortgage or invest your extra cash? read more

Health Savings Accounts: Are They Just What the Doctor Ordered?

Most HSAs allow you to contribute through automatic transfers from a bank account or, if you're employed, through an automatic ... read more

Five Keys to Investing for Retirement

Making decisions about your retirement account can seem overwhelming, especially if you feel unsure about your knowledge of ... read more

All About Credit Scores

It's difficult to imagine functioning in today's world without credit. Whether buying a car or purchasing a home, credit has become an ... read more

Are My Social Security Benefits Subject to Income Tax?

A portion of your benefits may be subject to income tax if your modified adjusted gross income (MAGI), plus one-half of your Social ... read more

Are my student loan payments tax deductible?

Your actual student loan payments aren't deductible, but the interest portion might be, thanks to the student loan interest deduction. ... read more

Charitable Giving

Charitable Giving Charitable giving can play an important role in many estate plans. Philanthropy cannot only give you great personal ... read more

Watch Out for These Common Tax Scams

While tax scams are especially prevalent during tax season, they can take place anytime during the year. If you see a scam, be sure to report it to the Internal Revenue Service at irs.gov, the Federal Trade Commission at ftc.gov, the Treasury Inspector General for Tax Administration at tigta.gov,and/or your local police department. read more

Comparison of Types of Life Insurance

Term Whole Life Universal Life Variable Life Variable Universal Life Premium Premiums increase at each ... read more

Retirement Plan Limits on the Rise in 2022

Retirement savers have some reasons to celebrate in 2022. Many IRA and retirement plan limits are indexed for inflation each year. ... read more

What Will You Pay for Medicare in 2022?

Medicare premiums, deductibles, and coinsurance amounts change annually. Here's a look at some of the costs that will apply in 2022 if ... read more

Russia-Ukraine Conflict and your Investments

Over the past number of weeks, we have been monitoring the situation between Russia and Ukraine and its effects on markets and client ... read more

Help Wanted: Why Can’t Businesses Find Enough Workers?

COVID-19 may have kicked off a severe labor shortage, but longer-term demographic trends are partly to blame for this highly unusual ... read more

Federal Tax Filing Season Has Started

The IRS announced that the starting date for when it would accept and process 2021 tax-year returns was Monday, January 24, ... read more

Understanding Social Security

Approximately 69 million people today receive some form of Social Security benefits, including retirement, disability, survivor, and ... read more

Nuts and Bolts: How to Roll Over Your Employer Retirement Plan Assets

There are two types of rollovers: direct and indirect. A direct rollover is paid from your plan directly to your IRA or to your new ... read more

Education Tax Credits

It's tax time, and your kitchen table is littered with papers and forms. As if this isn't bad enough, you recently paid your child's ... read more

Social Security’s Uncertain Future: What You Should Know

Even if you won't depend on Social Security to survive, the benefits could amount to a meaningful portion of your retirement ... read more

Employer Open Enrollment: Make Benefit Choices That Work for You

One of your insurance options could be a better fit for your family and might even help reduce your overall health-care costs.Open ... read more

Understanding Risk

What is risk? In general Risk is all around us, and we all take risks every day. Some people consider driving a car risky. Others ... read more

Deciding When to Retire: When Timing Becomes Critical

Retirement: a state of mind Don't underestimate the psychological issues involved in deciding when to retire. Many people welcome the ... read more

Changing Jobs? Know Your 401(k) Options

If you've lost your job, or are changing jobs, you may be wondering what to do with your 401(k) plan account. It's important to understand your options. read more

Introduction to Investment Planning

What is investment planning? The investment planning process If you're fortunate enough to have money left over after paying the costs ... read more

Retirement Planning Considerations for a Stay-at-Home Spouse

Married couples often decide together that one spouse should be the primary breadwinner while the other stays home to take care of family members. Although this often works out well for childrearing or eldercare responsibilities in the short term, it can present long-term retirement-planning risks for the stay-at-home spouse. For this reason, couples should familiarize themselves with a few spousal rules related to retirement plans. read more

Types of Life Insurance Policies

You know that you need life insurance. However, with the wide variety of insurance policies available, you may find choosing the right ... read more

Understanding Your Credit Report

Your credit report contains information about your past and present credit transactions. It's used primarily by potential lenders to ... read more

Tax Planning for Income

You don't want to pay more in federal income tax than you have to. With that in mind, here are five things to consider when it comes ... read more

Understanding IRAs

An individual retirement arrangement (IRA) is a personal savings plan that offers specific tax benefits. IRAs are one of the most ... read more

Sticker Shock: Creative Ways to Lower the Cost of College

Even with all of your savvy college shopping and research about financial aid, college costs may still be prohibitive. At these ... read more

Life Insurance at Various Life Stages

Your need for life insurance changes as your life changes. When you're young, you typically have less need for life insurance, but ... read more

Trust Basics

Whether you're seeking to manage your own assets, control how your assets are distributed after your death, or plan for incapacity, trusts can help you accomplish your estate planning goals. For more information, consult an experienced attorney. read more

Tax Benefits of Home Ownership

In tax lingo, your principal residence is the place where you legally reside. It's typically the place where you spend most of your ... read more

Taking Advantage of Employer-Sponsored Retirement Plans

Employer-sponsored qualified retirement plans such as 401(k)s are some of the most powerful retirement savings tools available. If your employer offers such a plan and you're not participating in it, you should be. Once you're participating in a plan, try to take full advantage of it. read more

Research Tips When Choosing a College

It seems like only yesterday you were bandaging scraped knees and waving at the school bus, and now it's time for your child to choose ... read more

Estate Planning: An Introduction

By definition, estate planning is a process designed to help you manage and preserve your assets while you are alive, and to conserve ... read more

Teaching Your Teen about Money

Your teen is becoming more independent, but still needs plenty of advice from you. With more money to spend and more opportunities to ... read more

Personal Deduction Planning

Taxes, like death, are inevitable. But why pay more than you have to? The trick to minimizing your federal income tax liability is to ... read more

Annuities and Retirement Planning

You may have heard that IRAs and employer-sponsored plans [e.g., 401(k)s] are the best ways to invest for retirement. That's true for many people, but what if you've maxed out your contributions to those accounts and want to save more? An annuity may be an appropriate investment to look into. read more

Our Investment Strategy for the Upcoming Election

As we approach the upcoming Presidential election, we want to share with you our view on how best to navigate the investment markets. As you know, we do not attempt to predict the future, but rather focus on information and fundamentals. Making significant asset allocation changes based on short-term election cycle volatility can be detrimental to long-term investment returns, and market timing is rarely a winning strategy. read more

Best Places to Work 2020

WNY Asset Management is honored as a finalist in the Business First “Best Places to Work” 2020 micro category for companies with under 25 employees. read more

Back to Work Plan — Update

In response to the COVID-19 outbreak, WNY Asset Management has implemented the below changes. The Firm is introducing a new Health and ... read more

Back to Work Plan

In response to the COVID-19 outbreak, WNY Asset Management has implemented the below changes. The Firm is introducing a new Health and ... read more

COVID-19 Update April 22

As we continue to monitor the progression of COVID-19 and the impact on global markets and economies, we thought it was important to ... read more

CARES Act Provides Relief to Individuals and Businesses

On Friday, March 27, 2020, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law. This $2 trillion ... read more

SMARSH Emails Are Legitmate

SMARSH Emails are Legitimate WNY Asset Management, uses the company, SMARSH, to encrypt our emails for security reasons. Depending on ... read more

Investment Strategy Update

Over the past six weeks we have been proactively adjusting our investment models, held at TD Ameritrade, to manage volatility and to ... read more

COVID-19 Update March 25

To our clients, families & friends: We all know that the ongoing COVID-19 response effort continues to impact our communities. ... read more

COVID-19 Update March 16

To Our Valued Clients, As the novel coronavirus (COVID-19) continues to impact our communities, we wanted to take a moment to update ... read more

Zachary Shroyer Joins WNY Asset Management

Zachary Shroyer, CPA joined our team on November 22, 2019 as our Director of Finance. Zach comes to us from Brock, Schechter & ... read more

Ryan Feuerstein Joins WNY Asset Management

Ryan Feuerstein joined WNY Asset Management on July 1, 2019 as a Wealth Manager. He is also a part of the firm’s investment ... read more

Tina Harman Joins WNY Asset Management

Tina Harmon, CPA, MBA joined our team on February 19, 2019 as our Chief Financial Officer (CFO). Tina comes to us from Immco ... read more

Matthew Bomgaars joins WNY Asset Management

Matthew Bomgaars joined our team on November 4, 2018. Matthew is a Wealth Manager working on Ronald Lojacono's team. Matt comes to ... read more

Nicholas Scibilia Joins WNY Asset Management

We are happy to announce that we have a new member of our team at WNY Asset Management. Nicholas Scibilia has taken on the position ... read more

Spectrum Wealth Management becomes a branch of WNY Asset Management

Recently, Spectrum Wealth Management has become a branch office of WNY Asset Management, LLC, creating one of the largest locally ... read more

Matthew Newman Earns CFP® Certification

Matthew Newman CFP®, Wealth Manager at WNY Asset Management, has earned the Certified Financial Planner certification by successfully ... read more

David Jarosz Joins the WNY Asset Management Team

David has over two decades of wealth management, financial planning and long term care planning experience. While majoring in Finance ... read more

Peter Kazmierczak Joins the WNY Asset Management Team

Peter brings team leadership and diverse industry work experience to his Planning Associate responsibilities at WNY Asset Management. ... read more

WNY Asset Management Volunteers at the Food Bank of WNY

Our jobs included sorting and packaging food inside the warehouse and landscape work outside. We greatly appreciate the opportunity ... read more

Laureen Syta Joins the WNY Asset Management Team

Assisting Rob Castiglione, Laureen brings a wealth of formal professional education and career experience to the WNY Asset Management ... read more

Debra Brown Earns CFP® Certification

WILLIAMSVILLE, NY - Debra A. Brown CFP®, Wealth Manager at WNY Asset Management has earned the Certified Financial Planner ... read more

WNY Asset Management is Ranked as one of WNY’s Fast Track Companies

WNY Asset Management is honored to be presented with the 2016 Fast Track Award. This award is presented to privately held Western New ... read more

WNY Asset Management takes part in the 2016 United Way Day of Caring

WNY Asset Management, LLC participates in the United Way Day of Caring for the fourth year in a row. This year the mission was ... read more

WNY Asset Management takes part in the 2015 United Way Day Of Caring

WNY Asset Management, LLC participates in the United Way Day of Caring and is assigned to the Ronald McDonald House along with other ... read more

Matthew Newman Joins the WNY Asset Management Team

Matt is a Wealth Manager at WNY Asset Management and brings broad-based experience in economic and financial modeling, including ... read more

Patrick Kinsley Jr. Joins the WNY Asset Management Team

In his role as Investment Analyst, Patrick is a member of the firm’s Investment Management Committee. He works closely with our wealth ... read more

Debra Ishman Joins the WNY Asset Management Team

Debra serves as an Associate Wealth Manager for the firm. She is a part of the Financial Planning Team where she helps prepare ... read more

O’Connor Earns CFP® Designation

WILLIAMSVILLE, NY – Eugene P. O’Connor, Jr., CFP,® Senior Wealth Manager at WNY Asset Management, has earned the Certified Financial ... read more

Promotion of Yvonne Dryfhout to Client Service Associate

WNY Asset Management, LLC announces the promotion of Yvonne Dryfhout to the position of Client Service Associate where she will be ... read more

WNY Asset Management takes part in the 2014 United Way Day Of Caring

WNY Asset Management, LLC participates in the United Way Day of Caring and is assigned to the Buffalo City Mission, along with other ... read more

Alicia Boice joins the WNY Asset Management Team

Alicia provides our clients with a wide range of support in her role as Operations Administrator. Having spent more than eight years ... read more

WNY Asset Management is ranked in Financial Advisor RIA Survey & Ranking 2014

WNY Asset Management, LLC is honored to be Nationally ranked in Financial Advisor RIA Survey & Ranking 2014. Download PDF read more

WNY Asset Management is ranked in Business First as Who’s Who in Business and Finance 2014

WNY Asset Management, LLC is honored to be ranked in Buffalo Business First as Who’s Who in Business and Finance 2014. Download PDF read more

Jennifer Topp joins the WNY Asset Management Team

Assisting Vince Wagner and Evan Wardner, Jennifer brings a broad business acumen and client-first approach to her role as Client ... read more

WNY Asset Management is ranked in Business First as Who’s Who in Business and Finance 2013

WNY Asset Management is honored to be ranked in Buffalo Business First as Who’s Who in Business and Finance 2013. Download PDF read more

Christine Kennedy joins the WNY Asset Management team

WILLIAMSVILLE, NY – Christine Kennedy joins the WNY Asset Management Team as a CPA Member Administrator. Christine provides critical ... read more

WNY Asset Management names O’Connor Senior Wealth Manager

WILLIAMSVILLE, NY – WNY Asset Management has appointed Eugene P. O’Connor, Jr. senior wealth manager for the Williamsville, NY based ... read more

WNY Asset Management names Frattali Investment Analyst

WILLIAMSVILLE, NY – WNY Asset Management has appointed Phillip M. Frattali, Jr. investment analyst. Frattali joined the firm in ... read more

Vincent R. Wagner, CFP® joins WNY Asset Management, LLC

WILLIAMSVILLE, NY – WNY Asset Management has appointed Vincent R. Wagner, CFP®, to the position of Associate Wealth Manager. Wagner ... read more

Willard joins WNY Asset Management

WILLIAMSVILLE, NY – WNY Asset Management has appointed Linda A. Willard staff accountant. Willard comes to the Williamsville-based ... read more

Promotion of Ronald Lojacono to Partner

WNY Asset Management, LLC announces the promotion of Ronald Lojacono to the position of Partner. Ron joined the firm in 2005 as a ... read more

Roseann Gannon joins WNY Asset Management

WNY Asset Management, LLC welcomes Roseann Gannon as a Client Relationship Manager. Roseann brings more than 25 years of experience in ... read more

Annette Wargo joins WNY Asset Management

WNY Asset Management, LLC has hired Annette Wargo as Controller. Annette joins the firms with an extensive accounting background, ... read more

Promotion of Susan Volpe to Manager, Client Administration

WNY Asset Management, LLC announces the promotion of Susan Volpe to Manager, Client Administration. Sue joined the firm in 2006 after ... read more

Kimberlee Rooth joins WNY Asset Management

WNY Asset Management, LLC welcomes Kimberlee Rooth as a Relationship Manager. Kim brings fourteen years of experience in the financial ... read more

Lisa Williams joins WNY Asset Management, LLC

WNY Asset Management, LLC welcomes Lisa Williams as a Relationship Manager. Lisa brings nine years of experience from the banking, ... read more

WNY Rankings

WNY Asset Management is honored to be ranked as one of the largest Financial Planning firms in Western New York.

Financial Planning:

- 2023 Buffalo Business First Financial Planning Rankings

- 2022 Buffalo Business First Financial Planning Rankings

- 2021 Buffalo Business First Financial Planning Rankings

- 2020 Buffalo Business First Financial Planning Rankings

- 2019 Buffalo Business First Financial Planning Rankings

- 2018 Buffalo Business First Financial Planning Rankings

- 2017 Buffalo Business First Financial Planning Rankings

- 2016 Buffalo Business First Financial Planning Rankings

- 2015 Buffalo Business First Financial Planning Rankings

- 2014 Buffalo Business First Financial Planning Rankings

- 2013 Buffalo Business First Financial Planning Rankings

- 2012 Buffalo Business First Financial Planning Rankings

- 2011 Buffalo Business First Financial Planning Rankings

- 2010 Buffalo Business First Financial Planning Rankings

- 2009 Buffalo Business First Financial Planning Rankings

- 2008 Buffalo Business First Financial Planning Rankings

WNYAssetManagment-TheList-2023WNYAssetManagment-TheList-2023WNYAssetManagement-TheList-2023